__________________

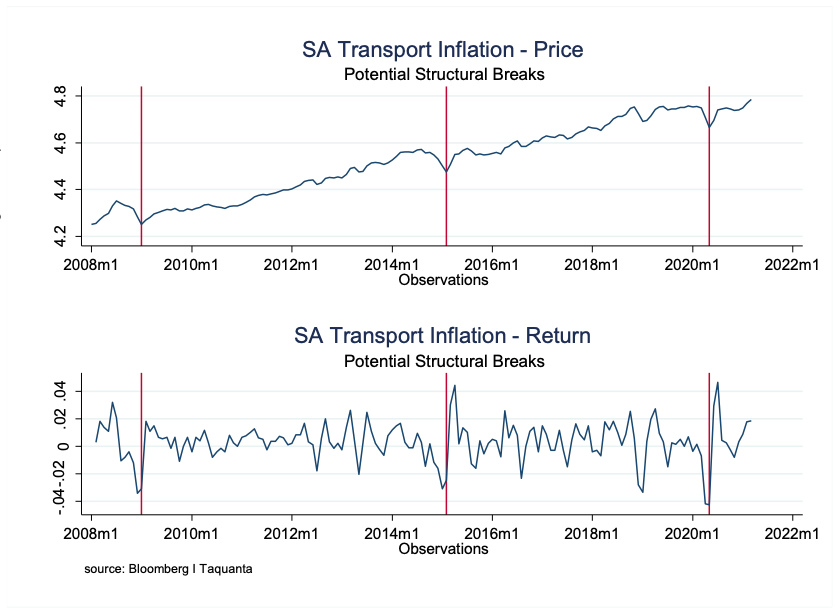

South Africa’s transport inflation index suffered a notable shock following the outbreak of the novel COVID-19 virus, mainly driven by severe lockdown restrictions and surplus global oil inventory levels. Similar shocks have also been encountered in recent history, especially during periods of recession and heightened political turbulence. These disturbances are usually accompanied by increases in price volatility levels (see red lines in Figure 1).

Figure 1: SA Transport Inflation Structural breaks and the price-return volatility thereof

But has the trajectory of transport inflation been adversely affected following these economic shocks? And more importantly, has the growing preference for remote/virtual working along with rising risks of multiple COVID-19 waves instigated a structural shift to transport prices? In other words, has the consumption of transport related services significantly and permanently changed since the 2020 oil market contagion? And what impact will this have on the broader Consumer Price Inflation (CPI) basket, if any?

Empirical evidence only points towards a short-term structural break, with transport prices having already recovered since March 2020. A low interest rate environment buoyed a sharp recovery in vehicle sales, which makes up 43% of the transport inflation index. Versus a year ago, Naamsa vehicle sales have rebounded by well over 6000%, and are envisaged to remain resilient on the back of accommodative monetary policy and improving global economic conditions.

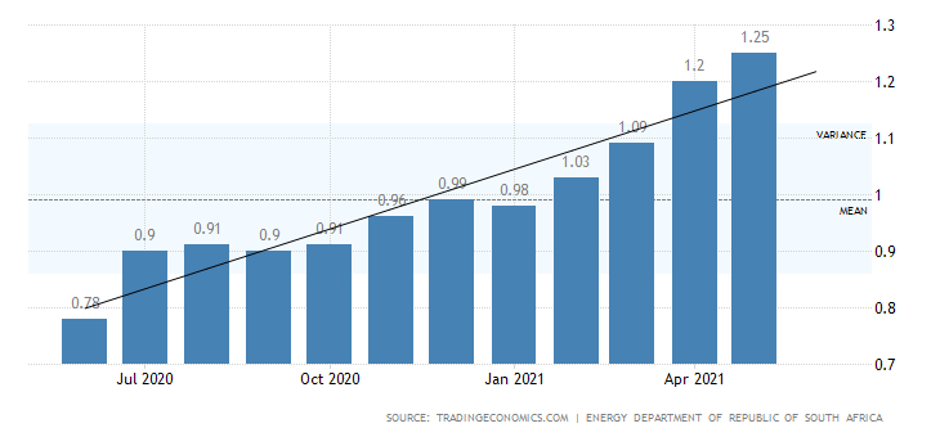

Public transport, which accounts for 16% of the transport inflation index is very synonymous with “menu costs”. This means that the cost of public transport does not respond to negative fuel price shocks, instead it quickly adjusts to oil price hikes. The international price of oil rose from approximately $27 per barrel in April 2020 to around $50 by the end of 2020 and to $65 in April 2021. Notwithstanding a stronger ZAR, the net ramifications were an annual inflation rate for fuel of 21.4% in April, with a monthly increase of 5.4%.

Figure 2: SA Fuel Prices Fuel prices in South Africa show steady increase since pandemic.

The gradual easing of lockdown restrictions from alert level 5 to alert level 2 has also seen a steady rise in demand for private transport operations to the tune of 18.5% y/y and 4.4% m/m, respectively. Private transport operations make up the remaining 41% of the transport inflation index. The price inelastic demand for fuel across tertiary sectors of the economy, coupled with persistently increasing fuel levies now implies increasing indirect transport costs to households, despite reduced average miles per capita.

The overall effect of moderated household fuel consumption along with higher transport costs will determine if whether the transport inflation weighting of 14.28% will materially change at the next CPI basket weight review. Statistics South Africa is expected to conduct the next round of household income and expenditure surveys (IES) in 2022/2023 following the recent update in 2018/2019.

Despite the 4-year lag in the IES, CPI weightings are usually affected by sharp changes in consumer preferences, poor survey responses (mostly in affluent areas), the under reporting of sin purchases (i.e., gambling and alcohol consumption), and different methods applied in estimating net household expenses (i.e., net costs after adjusting for municipal, medical and tax rebates).

The above shortcomings are usually less prevalent with respect to household transport costs. Furthermore, the statistical insignificance of permanent structural breaks in transport costs currently implies limited changes to CPI in line with previous temporary shocks. In this instance, the rise in fuel costs looks to have moderately outweighed the net decrease in household demand levels.

Press Release

Media Announcement: Taquanta Acquires the Entire Issued Share Capital of Ngwedi Investment Managers (NIM)

Video

Optimizing Short-Term Yield- Interview with Manager of Nedgroup Investments Cash Funds